- USD ЦБ 03.12 30.8099 -0.0387

- EUR ЦБ 03.12 41.4824 -0.0244

|

Краснодар:

|

погода |

Курсы

Индексы

- DJIA 03.12 12019.4 -0.01

- NASD 03.12 2626.93 0.03

- RTS 03.12 1545.57 -0.07

ГОСУДАРСТВЕННЫЙ ТАМОЖЕННЫЙ КОМИТЕТ

РОССИЙСКОЙ ФЕДЕРАЦИИ

ПИСЬМО

от 19 июня 2001 года N 07-14/24055

О сертификате происхождения товаров формы "А"

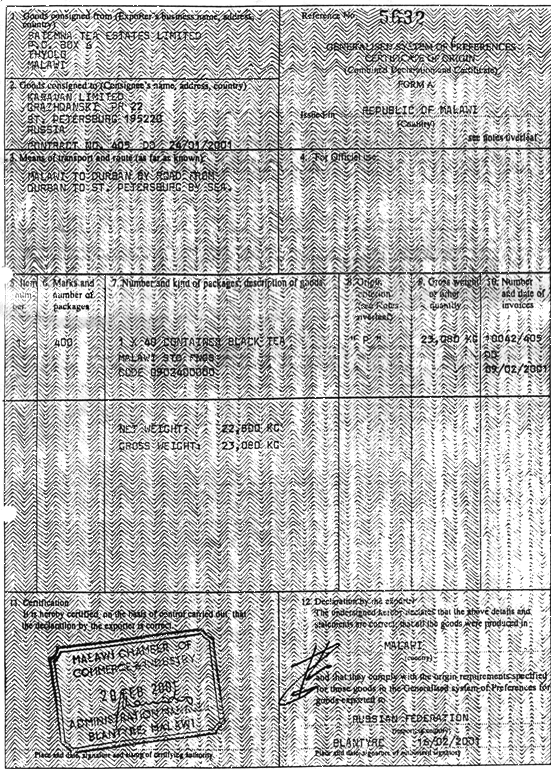

Главное управление тарифного и нетарифного регулирования Государственного таможенного комитета Российской Федерации, рассмотрев обращение таможни относительно принятия в качестве основания для предоставления тарифных преференций сертификата происхождения товаров формы "А" N 5632 от 20.12.2001 (оригинал прилагается), сообщает следующее.

В соответствии с пунктом 6 Правил определения происхождения товаров развивающихся стран при предоставлении тарифных преференций в рамках Общей системы преференций и пунктом 4 письма ГТК России от 30.05.2001 N 07-14/21285 тарифные преференции не предоставляются в отношении товаров, происходящих из страны - пользователя схемой преференций Российской Федерации, если наименования, адреса и образцы оттисков печатей компетентных органов, уполномоченных заверять сертификаты в данной стране, не представлены этими органами в ГТК России и не доведены Главным управлением тарифного и нетарифного регулирования (ГУТНР) ГТК России до таможенных органов.

В этой связи данный сертификат не может быть принят в качестве оснований для предоставления тарифных преференций.

К указанным в сертификате товарам может быть восстановлен преференциальный режим при условии предоставления в ГУТНР вышеуказанной информации.

Первый заместитель начальника

Главного управления тарифного и нетарифного

регулирования полковник таможенной службы

А.М.Максимов

Приложение

Notes

1. Countries which accept the form for the purpose of the Generalised System of Preferences (GSP)

Australia

Austria

Canada

Finland

Japan

Norway

Sweden

Switzerland

United States of America

Europian Economic Community

Belgium

Denmark

France

Federal Rebublic of Germany

Ireland

Italy

Luxermbourg

Netherlands

United Kingdom

Details of the governing admission to GSP in this countries are obtainable from the Customs authorised there. The main elements of the rules are indicated in the following paragraphs.

2. Conditions. The main conditions for admission to preference are that goods sent to any of the countries listed above:

(i) must follow within 3 description of goods eligible for perference in the country of destination; and

must comply with the consignment conditions specified by the country of destination. In general, goods must be consigned direct from the country of exporation to the country of destination but cases passage through one or more intermediate countries with or without transhipment, is accepted provided that at the time they are exported the goods are cleary insended for the declared country of destinatin and thay any Intermediate transit, transhipment are temporary were housingsite only from the requirements of transportation; and

(ii) must comply with the consignment conditions specified by the country of destination. In general goods must be consigned direct from the country of destination but in most cases passage through one or more intermediate countries, with or without transhipment, is accepted provided that at the time they are exported the goods are clearly intended for the declared country of destination and that any intermediate transit, transhipment or temporary warehousing arises only from the requirements of transportation and

(iii) must comply with origin criteria specified for those goods by the country of destination. A summary indication of the rules generally applicable is given in paragraph 3 and 4.

3. Origin criteria. Exports to the above mentioned countries, with the exception of Australia, Canada, and the USA, the position, is that either

(i) the goods shall be wholly produced in the country of exportation, that is they should fall within a description of goods which is accepted as wholly produced" under the rules prescribed by the country of destination concerned, or

(ii) altenatively, if the goods are manufactured wholly or partly from materials or componets imported into the country of exportation or of undermained origin this materials or componets must have undergone a substantial transformation there into a different product. It is impotant to note that all materials and componets which cannot be of that country's origin must be treated as if they were imported. Usually the transformation must be such as to lead to the exported goods being classified under a Customs Coorperation Council. Nomenclatute Tariff heading other than that relating to any of above materials of components used. In addition special rules are prescribed for various classes of goods in Lists A and B of certain countries rules of origin and other subsidiary provisions and these should be carefully studied.

If the goods qualify under the above criteria, the exporter must indicate in Box 8 of the form the origin criteria on basis of which he claims that his goods quality for the GSP, in the manner shown in the following table

|

|

Circumstances of production or manufacture in the first country named in Box 12 of the form |

|

Insert in Box В | ||

|

(a) |

Goods worked upon but not wholly produced in the exporting Country which were produced in conformity |

|

"A" followed by the Customs Cooperation Council Nomenclature heading number of the exported | ||

|

|

with the principles of paragraph 3 (ii) which fall under a CCC Nomenclature Tariff heading specified in column 1 of List A and which satisfy any conditions in columns 3 and 4 of List A which are relevant to these goods |

|

goods Example: |

"A" | |

|

(b) |

Goods worked upon but not wholly produced in the exporting Country which fall within an item in column 1 of List B and Which comply with the |

|

"B" followed by the Customs Cooperation Council Nomenclature heading number of the exported goods | ||

|

|

provisions of that item |

|

example: |

"B" | |

|

(c) |

Goods, worked upon but wholly produced in the exporting Country, which were produced in confirmity with the principles. Or para 3 (ii) which are |

|

"X" followed by the Customs Cooperation Council Nomenclature heading number of the exported goods | ||

|

|

not specifically refered to in List A and Which do not cont….. a general provision of List A |

|

example: |

"X" | |

|

(d) |

Goods wholly produced in the country of exportation (see para 3 (l) above) |

|

"I" | ||

Note: List A and List B refer to the lists of qualitying processes specified by the countries of importation concerned

Origin criteria for exports to Canada and United States of America. For export to the these two countries, the position is that either

(i) the goods shall be wholly produced in the country of exportation, that is, they should fall within a description of goods which is accepted as "wholly produced" under the rules prescribed by the country of destination concerned, or

(ii) alternatively, if the goods are manufactured wholly or partly from materials or comonest imported in the country of exportations on the undetermined origin those materials or componest must have undergone a substantial transformation there into a different product. It is important to note that all materials and componets which cannot be shown to be of that country's origin must treated as if they were imported.

(a) In the case of Canada the value of such materials and componets (excluding any that are of Canadian Origin) must not exceed 40 percent of the Exfactory price of the exported article.

(b) In the case of the United States the cost or value of material produced in the beneficiary contry plus the direct cost of processing performed there. Should not be less than 35 percent for single countries or 50 percent, when an association of countries is treated as one country, of the appraised value of such article at the time of its entry into the U.S. Materials imported into beneficiary country and then substainially transformed into constituent materials of which the eligible article is composed may be included in calculating the minimum pereentages. The phrase "direct costs of processing" includes costs directly incurred or reasonableallocated to the processing, such as all actual labour costs, dies, molds, tooling, and deprectation; reseach and development; inspection and testing, but does not include business overheads, administrative expenses and salaries, or Profits.

If the goods quality under the above Criteria, the exporter must indicate in the Box 8 of the form the origin criteria on the baisis of which the claims that his goods quality for the GSP in the manner shown on the following table:

For Australia, main requirement is exporter's declaration on normal commercial invoice. Form A is an acceptable alternative, but official certification is not require Direct consignment is not necessary.

|

Countries |

Circumstances of production of manufacture in the First country named in box 12 of the form |

Insert in the box 8 | |||

|

Canada and United States |

(a) |

Goods wholly produced in the country of ex Portation (see para 4 (4) above) |

"P" | ||

|

Canada |

(b) |

Goods which are covered by the value added Rule described in para 4 (ii) (4) above |

"Y" followed by the value of materials and componets imported (excludin any that are of Canadian origin or of undetermained origin, expressed as a percentage of the exfactory price of the exported goods | ||

|

|

|

|

example |

"Y" | |

|

|

|

|

|

36% | |

|

United States |

(c) |

Goods which are covered by the value added rule described in para 4(ii) (b) above |

For single country shipments insert "Y" or for shipments from. An association of countries "Z" followed by the sum of the Cost or value mof the material and the direct cost of processing expressed as a percentage of ex-factory price of the exported good | ||

|

|

|

|

example: |

"Y" 38% or | |

|

|

|

|

|

"Z" 52% | |

5. Each article must qualify. It should be noted that all the goods is a sonsigment must qualify seperately in their own right. This is of particular relavance when similar articles of different sizes or spare parts are sent.

6. Described of goods. The description of goods must be sufficiently detailed to enable the goods to be identified by the Customs Officer examaining them.

Текст документа сверен по:

рассылка

Концессии в здравоохранении ограничат для защиты пациентов

Концессии в здравоохранении ограничат для защиты пациентов  Создайте свой интернет-магазин на новой платформе ReadyScript

Создайте свой интернет-магазин на новой платформе ReadyScript  Хостинг, домены, VPS/VDS, размещение серверов

Хостинг, домены, VPS/VDS, размещение серверов